Key Points

-

The median U.S. household has saved just a fraction of the amount recommended for retirement.

-

The stock market is a crucial tool everyone should use to varying degrees.

-

Managing risk becomes a top priority as you age.

Everyone dreams of a comfortable retirement, but it’s a reality too few realize. The median U.S. household aged 65 to 74 has just $200,000 saved for retirement.

Using the popular 4% rule, a retiree would only be able to withdraw about $8,000 from their savings annually. That leaves many people in financial distress as they exit the workforce, even when factoring in Social Security benefits. It helps explain why the average retirement age in the United States has slowly crept higher over the past few decades — an increasing number of people can’t afford to retire any sooner.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Investing is important because it can help your savings grow over time, but how do you know if you’re on track? Unfortunately, they don’t teach you this in most schools.

Don’t worry, I’ve done the homework for you. Here’s what you need to know.

Image source: Getty Images

Experts recommend accumulating 10 times your salary by age 67

According to experts at Fidelity, the largest provider of 401(k) plans in the United States, people should aim to accumulate 10 times their salary by age 67.

The median U.S. household’s annual income is roughly $80,000, so that would mean having somewhere around $800,000. In other words, the median household is entering its retirement years with only about a quarter of what it should have. That’s a serious shortfall, and it explains why so many people struggle financially after they stop working.

It’s important to remember that Fidelity’s recommendation is a broad guideline. Your circumstances will affect your planning. Perhaps you want to retire early or move to an area with a low cost of living — either will change how much you should have saved. A credentialed financial advisor can be a tremendous help in establishing a road map to retirement based on your personal situation.

Why investing is so important

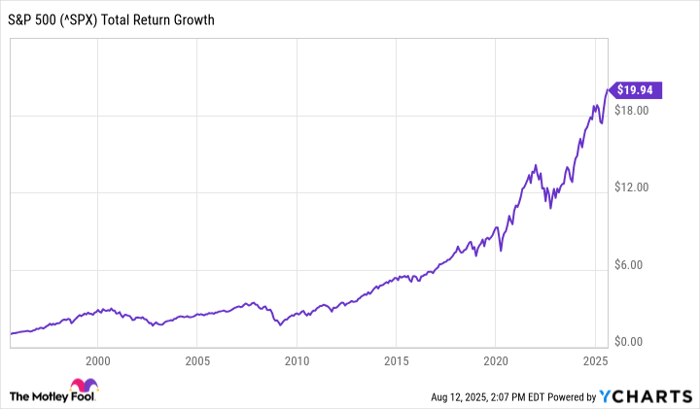

Almost anyone saving for retirement is going to want to invest their money. The stock market can be volatile at times, but it’s arguably the most proven wealth-building machine in modern history. The S&P 500 has delivered an average annual return of about 10% since 1957. And in the past three decades, the index has turned each dollar invested 30 years ago into nearly $20 today (with dividends reinvested).

Data by YCharts.

Of course, past results don’t guarantee future outcomes, and the index didn’t climb in a straight line upward. That said, most bank accounts pay little to no interest, and even high-yield savings accounts paying 4% to 5% lag behind the S&P 500 by a wide margin. Historically speaking, it pays to invest in the best U.S. companies and to hold them over the long term.

Unless they invest at least some of their money in the stock market, most people won’t earn a sufficient return on their savings to accumulate a large enough nest egg by the time they retire.

Don’t take on excessive risk trying to play catch-up

Investing for retirement can be simple, but it’s not always easy.

People who see Fidelity’s guideline may panic and try to rapidly make up ground in their retirement savings. That can lead to poor risk management, even if they don’t realize it at the time. For example, someone who plans to retire in a few years should not have their entire portfolio in cryptocurrencies and technology stocks, given how volatile they can be. A major downturn for those assets near retirement could put a retiree in a tough position to fully recover from significant losses.

Instead, they should slowly transition to safer investments as they age, trading upside for stability. That’s why many workplace retirement plans offer target date funds that do this automatically, if you prefer a hands-off approach to saving for your golden years. Again, a financial advisor can help you determine the right level of risk for you.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.