Key Points

-

No announcement is of greater importance to Social Security beneficiaries than the annual cost-of-living adjustment (COLA) reveal.

-

Social Security’s 2026 COLA is on pace to do something that hasn’t been witnessed this century.

-

However, a silver lining that helped most beneficiaries in 2023 will be absent for a third consecutive year in 2026.

In May, Social Security retired-worker benefits made history by averaging over $2,000 per month for the first time in the program’s nearly 90-year history. While Social Security income isn’t making anyone rich, it is providing a financial foundation for more aging workers than you might realize.

In 2023, more than 22 million people were pulled above the federal poverty line by their Social Security payout, which included 16.3 million adults aged 65 and over. If this program didn’t exist, the poverty rate for seniors aged 65 and above would nearly quadruple from 10.1% to an estimated 37.3%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

For Social Security beneficiaries, no announcement is of greater importance than the annual cost-of-living adjustment (COLA) reveal, which will land on Oct. 15 this year. Even though Social Security’s 2026 COLA is on track to make history, a critical silver lining will be missing for a third consecutive year.

Image source: Getty Images.

Social Security’s COLA serves an important purpose

But before digging into the details of how the program’s COLA can make history in 2026 or unraveling its missing silver lining, it’s imperative to first understand what the cost-of-living adjustment is and the purpose it serves.

Put simply, Social Security’s COLA is the tool that attempts to ensure beneficiaries don’t lose buying power over time. For example, if a large basket of goods and services regularly purchased by beneficiaries increases in cost by 2.5% from one year to the next, Social Security benefits would need to rise by the same percentage; otherwise, recipients wouldn’t be able to buy as much with their Social Security income.

From the first mailed retired-worker benefit check in 1940 through 1974, COLAs were assigned with no particular rhyme or reason by special sessions of Congress. For instance, no COLAs were passed along during the entirety of the 1940s, which was followed by the largest benefit increase on record (77%) in 1950.

This changed in 1975, with the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) becoming the annual inflationary tool for the program. The CPI-W has well over 200 price categories, each of which has its own unique percentage weightings. These weightings allow the CPI-W to be whittled down to a single figure each month, which makes it incredibly easy to see whether prices are collectively climbing (inflation) or falling (deflation) over time.

The most unique aspect of Social Security’s COLA calculation is that only readings from July through September (the third quarter) factor in. If the average CPI-W reading in the third quarter of 2025 is higher than the comparable period of 2024, beneficiaries can expect a “raise” in 2026.

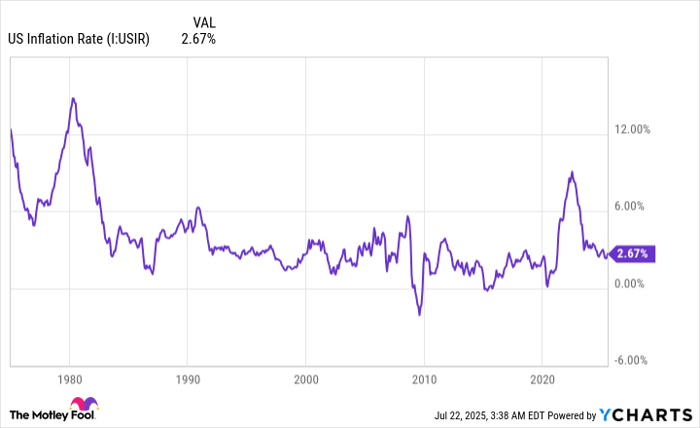

A rapid increase in the prevailing rate of inflation sent COLAs soaring in recent years. U.S. Inflation Rate data by YCharts.

Social Security’s 2026 cost-of-living adjustment is on the verge of making history

For the nearly 70 million beneficiaries who brought home a Social Security check in June, expectations for a robust payout boost in 2026 are high.

Throughout the 2010s, COLAs were consistently disappointing. Deflation resulted in no COLA being passed along in 2010, 2011, and 2016, and the 0.3% COLA in 2017 marked the smallest positive benefit boost in the program’s history. But this decade has flipped the script.

Due to a historic expansion in the U.S. money supply during the COVID-19 pandemic, the prevailing rate of inflation in the U.S. soared to a four-decade high. In turn, cost-of-living adjustments jumped to 5.9% in 2022, 8.7% in 2023, 3.2% in 2024, and 2.5% in 2025. For added context, the average annual increase over the last 16 years is 2.3%.

Following the release of the June inflation report by the U.S. Bureau of Labor Statistics, estimates for Social Security’s 2026 COLA were updated. For a fourth consecutive month, nonpartisan senior advocacy group The Senior Citizens League (TSCL) upped its 2026 COLA projection by one-tenth of a percent, to 2.6%. Meanwhile, Social Security and Medicare policy analyst Mary Johnson boosted her COLA forecast to 2.7%.

If we make the leap that one of these two forecasts proves accurate, it would mark the fifth consecutive year with an above-average cost-of-living adjustment (relative to COLAs since 2010), as well as the first time this century that COLAs have reached at least 2.5% for five consecutive years.

For those curious, Johnson’s high-end estimate of a 2.7% “raise” in 2026 would increase the average retired-worker benefit check by $54 per month to around $2,059.

As for workers with disabilities and survivor beneficiaries, a 2.7% COLA would increase average monthly payouts by approximately $43 and $42, respectively.

Image source: Getty Images.

Next year’s COLA is going to be short one important silver lining, yet again

On paper, the prospect of Social Security’s COLA growing by at least 2.5% for a fifth straight year probably sounds great. But dig beneath the surface and you’ll find that retirees are going to be shortchanged in more ways than one.

In July 2024, TSCL released a report comparing cumulative COLAs between 2010 and 2024 to the prevailing rate of inflation in a given year. Based on TSCL’s analysis, the purchasing power of a Social Security dollar has declined by 20% since 2010.

The loss of buying power is a function of the inherent flaws in the CPI-W. Even though 87% of the nearly 70 million people who take home a Social Security payment each month are aged 62 and over, the CPI-W tracks the spending habits of “urban wage earners and clerical workers” — in other words, working-age Americans who, in most cases, aren’t currently receiving a Social Security benefit. The costs that matter most to seniors, such as shelter and medical care services, are experiencing consistently higher rates of inflation than the annual COLA being passed along to beneficiaries.

However, this represents just half the problem for retirees.

Two years ago, something occurred that select Social Security beneficiaries had observed only twice this century: Medicare’s Part B premium declined! Part B is the segment of Medicare that handles outpatient services, and it’s often automatically deducted from the Social Security checks of enrollees each month.

In 2023, the Part B premium fell by 3%, primarily due to the lower-than-expected cost of an Alzheimer’s drug in 2022. This 3% drop in Part B premium, coupled with the largest percentage increase in Social Security’s COLA in 41 years (8.7%), offered a silver lining that allowed most beneficiaries to hang on to more of their “raise.”

Unfortunately, this silver lining disappeared in 2024 and 2025 and is all but certain to be absent next year as well.

In 2024, Medicare’s Part B premium rose by 5.9%, almost doubling the 3.2% COLA passed along that year. It increased by 5.9% yet again in 2025, which is more than double the 2.5% COLA passed on to recipients. Although the cost-of-living adjustment remains somewhat fluid for 2026, the recently released Medicare Trustees Report is projecting an 11.5% increase in the Part B premium to $206.20 per month next year. A double-digit year-over-year increase in Part B all but ensures that enrolled beneficiaries will see some or all of their payout bump next year gobbled up.

Not even a first-in-this-century COLA in 2026 can offset a steady decline in Social Security income buying power or Part B premium inflation that’s consistently dwarfing annual cost-of-living adjustments.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.