Key Points

-

There’s nothing more important for Social Security beneficiaries than knowing how much they’ll receive each month.

-

Social Security’s 2026 COLA estimates are narrowing, and it points to a fifth consecutive year of an above-average “raise” for beneficiaries.

-

However, inherent flaws with Social Security’s inflationary tether, coupled with a silver lining that’ll be missing for a third straight year, spell trouble for most Social Security recipients.

In July, more than 53 million retired workers brought home an average Social Security check of $2,006.69. While this is a relatively modest monthly payout that equates to a little over $24,000 in annual income, it’s proven vital to helping aging workers make ends meet.

Over the 24 years Gallup has conducted its annual survey to gauge how reliant retirees are on the Social Security income they receive, 80% to 90% of respondents have noted it’s a necessity, to some degree, to cover their costs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

For retired-worker beneficiaries, there’s nothing more important than knowing how much they’re going to receive each month, and there’s no event more anticipated than the annual cost-of-living adjustment (COLA) reveal in October.

With Social Security’s 2026 COLA estimates narrowing, projections can be made as to precisely how much benefits are expected to climb in the upcoming year.

Image source: Getty Images.

Social Security’s COLA plays an important role for beneficiaries

Before diving into the COLA estimates and doing the math, it’s imperative to first understand the purpose of Social Security’s cost-of-living adjustment, as well as how it’s calculated.

The program’s COLA can be best described as a tool that fights back against inflation (rising prices). If, for instance, the cost for a broad basket of goods and services regularly purchased by seniors was to climb by 3% from one year to the next, Social Security checks would also need to increase by a commensurate amount; otherwise, beneficiaries would lose buying power. Social Security’s COLA is the “raise” beneficiaries receive most years that attempts to account for the inflationary pressures they’re contending with.

Prior to 1975, cost-of-living adjustments were assigned with no rhyme or reason by special sessions of Congress. This included passing along the to-this-day largest COLA on record of 77% in 1950!

Since 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has served as Social Security’s inflationary measure. It’s more than 200 individually weighted categories allow the index to be chiseled down to a single figure each month, which makes for easy year-over-year comparisons to determine if prices are rising (inflation) or declining (deflation).

The curveball with Social Security’s COLA calculation is that it only uses CPI-W readings from the months of July, August, and September, i.e., the third quarter (Q3). If the average CPI-W reading from Q3 of this year is higher than the comparable period last year, beneficiaries will receive a benefit boost come January 2026.

How much benefits increase from one year to the next is determined by the year-over-year percentage difference in average Q3 CPI-W readings, rounded to the nearest tenth of a percent.

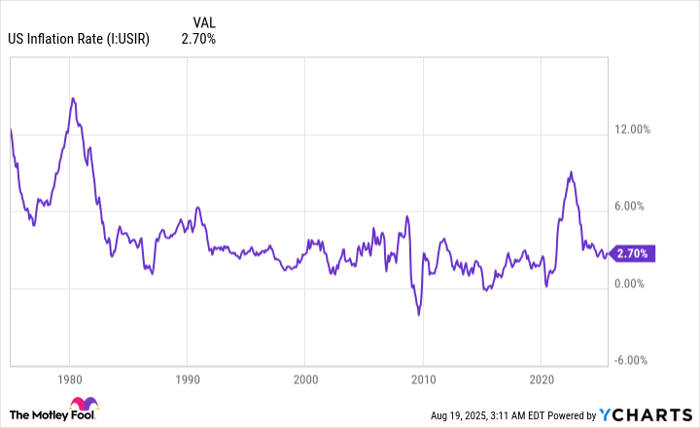

A rapid expansion in U.S. money supply sent the prevailing rate of inflation, and Social Security COLAs, notably higher in recent years. US Inflation Rate data by YCharts.

Here’s how much Social Security benefits are set to rise in 2026

Social Security COLAs were mostly forgettable throughout the 2010s. But due to the rapid expansion of U.S. money supply during the COVID-19 pandemic and a sizable subsequent uptick in the prevailing rate of inflation, cost-of-living adjustments have picked up in a big way over the last four years.

From 2022 through 2025, COLAs clocked in at 5.9%, 8.7%, 3.2%, and 2.5%, respectively. The 8.7% COLA in 2023 marked the largest on a percentage basis in 41 years, as well as the biggest year-over-year nominal-dollar increase in the program’s history.

With four consecutive COLAs surpassing the average “raise” of 2.3% over the last 16 years, beneficiaries are hoping this pattern continues. Based on independent estimates, they’re likely to get their wish.

For a fifth consecutive month, nonpartisan senior advocacy group The Senior Citizens League (TSCL) raised its 2026 COLA forecast by a tenth of a percent (this time to 2.7%) following the release of the July inflation report. Meanwhile, independent Social Security and Medicare policy analyst Mary Johnson kept her 2026 COLA estimate unchanged from the previous month at a now-TSCL-matching 2.7%.

What would a 2.7% cost-of-living adjustment look like in dollar terms for the average beneficiary?

With the aforementioned average retired worker check totaling $2,006.69 in July, a 2.7% COLA would add $54.18 per month come 2026 and increase expected annual payouts to north of $24,700.

But Social Security is about more than just aging workers. It also provides financial protections to workers with disabilities and survivors of deceased workers.

The average worker with disabilities can expect a 2.7% COLA to increase their payout by $42.72 per month to about $1,625. As for survivor beneficiaries, their average payout is estimated to climb by $42.51 per month in 2026 to approximately $1,617 with a 2.7% cost-of-living adjustment.

Image source: Getty Images.

The 2026 cost-of-living adjustment is likely to leave beneficiaries disappointed

While a fifth consecutive year of an above-average “raise” probably sounds great on paper, most beneficiaries are going to be left disappointed with the final figure, whether it’s 2.7% or some number relatively close to this percentage.

The prevailing problem with Social Security’s COLA is that its inflationary measure, the CPI-W, is inherently flawed. It’s an index specifically tasked with tracking the spending habits of “urban wage earners and clerical workers.” Even though 87% of Social Security recipients are seniors age 62 and over, the inflationary index the program relies on is tied to working-age Americans who, in many instances, aren’t currently receiving a Social Security check.

Compared to working-age Americans, retirees spend a disproportionately higher percentage of their budget on shelter and medical care services. However, these critical spending categories are being underweighted (for seniors) in the CPI-W. This has contributed to the buying power of a Social Security dollar declining by 20% since 2010, according to a TSCL analysis published in July 2024.

As long as the trailing-12-month inflation rate for shelter and medical care services remains higher than the COLA beneficiaries are receiving, their buying power will very likely continue to be eroded over time.

Furthermore, an important silver lining will be absent for a third straight year for most aged beneficiaries in 2026.

According to estimates in the 2025 Medicare Trustees Report, the Part B premium is forecast to increase by 11.5% to $206.20 per month in the upcoming year. Part B is the segment of Medicare responsible for outpatient services.

Retirees who are dually enrolled in Social Security and traditional Medicare almost always have their Part B premium automatically deducted from their Social Security benefit each month. The highest increase in the Part B premium since 2022 is bound to eat up some, or all, of the projected 2.7% COLA retirees are expected to receive in 2026.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.