Key Points

-

Between 80% and 90% of retirees consistently lean on their Social Security income, in some capacity, to make ends meet.

-

The latest Social Security Board of Trustees Report calls for the depletion of the OASI’s asset reserves in just eight years.

-

A laundry list of demographic changes is the primary culprit behind a projected 23% reduction in retired-worker benefits come 2033.

For most retired workers, Social Security is more than just a monthly deposit into their checking or savings account. It represents a pillar that, in many instances, is necessary to support their financial well-being.

In each of the last 24 years, national pollster Gallup has surveyed retirees to gauge how reliant they are on their Social Security income. In April, 86% of respondents pointed to their benefits as a “major” or “minor” income source. This is consistent with prior years, where 80% to 90% of retirees stated their reliance, in some capacity, on this leading social program.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Ideally, maintaining the health of America’s top retirement program should be the No. 1 priority of our elected officials. But based on the current trajectory of this vital program, retired-worker beneficiaries may be staring down a sizable reduction in their monthly payout come 2033.

Image source: Getty Images.

Retired-worker benefits may be slashed by up to 23% in eight years

Every year since the very first retired-worker check was mailed out in January 1940, the Social Security Board of Trustees has released a report detailing the financial outlook for the program. In addition to outlining how Social Security generates income and where each dollar ends up, the real value in these annual reports is the long-term (75-year) forecast provided by the Trustees.

They take into account changes in fiscal and monetary policy, along with a host of demographic shifts (e.g., birth and death rates, immigration rates, and so on), to determine how financially sound Social Security will be for the 75 years following the release of a report.

Over the last four decades, the Trustees have warned of an imminent long-term funding deficit. In simple terms, projected income to be collected in the 75 years following a report is expected to be insufficient to cover outlays, which primary means benefits, but also includes the administrative expenses to operate Social Security.

In the 2025 Trustees Report, this long-term unfunded obligation ballooned to $25.1 trillion, and it continues to climb.

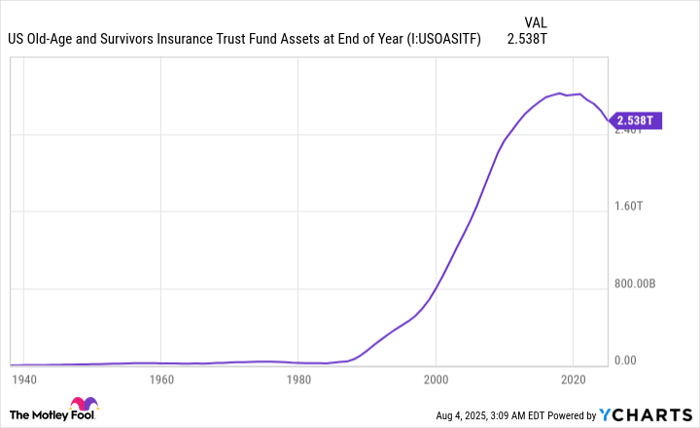

But believe it or not, this isn’t the biggest concern. The Old-Age and Survivors Insurance trust fund (OASI), which is responsible for doling out monthly benefits to retired workers and survivors of deceased workers, is forecast to exhaust its asset reserves by 2033. The OASI’s asset reserves represent the excess income built up since inception that hasn’t been outlaid and is invested in interest-bearing, special-issue government bonds, as required by law.

If the OASI’s asset reserve outflow isn’t addressed by Congress, it will run out in eight years. Although the Social Security program is in no danger whatsoever of going bankrupt or stopping payments, the existing payout schedule, inclusive of cost-of-living adjustments (COLAs), is very much in trouble. Depleting the OASI’s asset reserves is expected to slash monthly benefits for retired workers and survivors of deceased workers by 23%.

The OASI’s asset reserves can run dry by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Could you handle your Social Security check being reduced by $553/month?

However, it’s one thing to throw around percentages and an entirely different beast when digging into what those percentages might mean on a dollar basis.

In May, the average monthly Social Security retired-worker benefit made history by crossing above $2,000 for the first time in the program’s nearly 90-year history. As of June 2025, the 53 million retired workers receiving a monthly payout took home an average of $2,005.05, or a little over $24,000 on an annual run-rate basis.

But Social Security benefits aren’t static. Most years feature a COLA passed along by the Social Security Administration to fight back against a loss of buying power. In other words, if the collective cost for a huge basket of goods and services regularly purchased by retirees climbs by 3% from one year to the next, benefits would also need to rise by 3% to ensure they can still buy the same amount of goods and services. Social Security’s cost-of-living adjustment provides a near-annual bump in benefits to help counter inflation.

Over the last 16 years, the average Social Security COLA has clocked in at precisely 2.3%. If we extrapolate the average retired-worker payout in June 2025 to the same period in 2033, with the assumption that COLAs will average 2.3% annually, the typical monthly check will increase to about $2,405.

Yet if the Trustees’ projections are correct, the OASI will completely exhaust its asset reserves eight years from now. Should this happen, the average estimated retired-worker check of $2,405 would decline by 23%, or $553 per month, to approximately $1,852.

Considering how many aging workers rely on Social Security as a foundational income source, an average monthly payout cut of $553 would be devastating.

Image source: Getty Images.

The no-nonsense reasons Social Security is struggling

You’re probably wondering how America’s top retirement program got to the point where sizable benefit cuts are on the table in less than a decade. Rest assured, it has absolutely nothing to do with common internet-driven myths of lawmakers raiding Social Security’s trust funds or undocumented workers receiving traditional benefits.

Rather, Social Security’s worsening financial outlook boils down to an assortment of ongoing demographic changes.

Some of these changes are quite visible and well known to the American public. For example, baby boomers have been retiring and leaving the labor force in greater numbers for some time. There simply aren’t enough new workers entering the labor force to keep the worker-to-beneficiary ratio from declining.

However, other demographic shifts have somewhat flown under the radar but are having a huge impact on Social Security. In no particular order:

- The U.S. fertility rate has hit an all-time low, which threatens to further pressure the worker-to-beneficiary ratio in the years to come.

- Legal net migration into the U.S. has meaningfully declined since the late 1990s. Since most migrants entering the U.S. are young and will spend decades in the labor force contributing to Social Security via the 12.4% payroll tax on earned income, a decline in net migration rates is a problem.

- Rising income inequality has allowed more wages and salary to “escape” the payroll tax. In 2025, all earned income from $0.01 to $176,100 is subject to the payroll tax, with everything above the taxable earnings cap (the $176,100 figure) exempted. Over the last four decades, income for high earners has accelerated faster than the increase in the taxable earnings cap, thereby allowing more earnings to be exempted over time.

Lastly, lawmakers do deserve some blame. The longer Congress kicks the can down the road regarding the OASI’s imminent asset reserve depletion, the costlier it’s going to be to eventually “fix” Social Security. Although tackling the program’s issues can cost lawmakers votes in upcoming elections, tough decisions are going to need to be made sooner, rather than later.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.