Key Points

-

Your full retirement age (FRA) is when you’re eligible to receive your primary insurance amount.

-

Claiming standard or spousal benefits before reaching your FRA will permanently reduce the monthly amount you receive.

-

Earning over a certain amount while claiming benefits before your FRA could reduce your monthly benefit.

Social Security has been one of America’s most essential social programs for quite some time. After years of paying into the Social Security system, it’s a well-earned benefit. And for many Americans, it’s most or all of their retirement income.

Despite its importance, Social Security has many moving parts, which can be challenging to keep up with, even for people well-versed in the program. That’s why it’s a good idea to block out the fluff and focus on the most important parts of the program.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

If there’s one piece of advice I’d offer retirees or those approaching retirement, it would be to be aware of how much Social Security revolves around your full retirement age (FRA).

Image source: Getty Images.

Why your FRA is one of the most important Social Security numbers

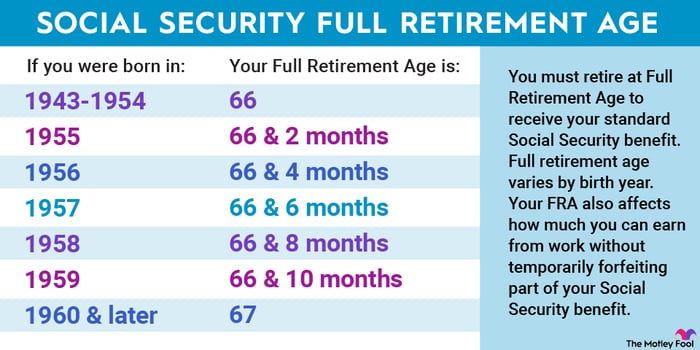

Your FRA is when you’re eligible to receive your primary insurance amount (PIA), which you can think of as your baseline benefit amount and the starting point Social Security uses to calculate your benefits. Here are FRAs based on birth years:

Image source: The Motley Fool.

Starting at your PIA, your monthly benefits are permanently affected based on when you claim relative to your FRA. Claiming before your FRA reduces your monthly benefit. If you’re within 36 months of your FRA, benefits are reduced by 5/9 of 1% each month you claim early. If you claim benefits more than 36 months before your FRA, benefits are further reduced by 5/12 of 1% monthly.

For someone whose FRA is 67, this means claiming benefits at 64 would reduce them by 20% and claiming at 62 (the earliest age you can claim) would reduce them by 30%. Those are significant deductions that warrant careful consideration of whether it’s worth claiming early with the reduced benefit amount.

On the opposite end, delaying benefits past your FRA increases them by 2/3 of 1% monthly, or 8% annually, until you turn 70. After 70, benefits are no longer increased by delaying them.

Spousal benefits also revolve around your FRA

Social Security spousal benefits allow someone to receive up to 50% of their partner’s PIA. However, similar to standard benefits, claiming spousal benefits before your FRA will also permanently reduce them. The only difference is by how much.

Claiming spousal benefits before your FRA will reduce your monthly benefit by 25/36 of 1% for the first 36 months. Every additional month after that further reduces benefits by 5/12 of 1% each month.

To see it in action, let’s assume your spouse’s PIA is $2,000, making you eligible to receive $1,000 if you claim at your FRA. If your FRA is 67 and you were to claim benefits at 64, your monthly benefit would be reduced by 25% ($750). If you claim spousal benefits at 62, they’d be reduced by 35% ($650).

Claiming benefits early and earning a certain amount could mean reduced benefits

Plenty of people claim Social Security benefits early and continue to work. There’s absolutely nothing wrong with that. However, if you decide to claim benefits early and continue working, you should be aware of how much you’re making because you could be subjected to the retirement earnings test (RET).

For those who won’t reach their FRA in 2025, the earnings limit is $23,400. Earning more than that will reduce your annual benefits by $1 for every $2 over. For those who will reach FRA this year, the limit is $62,160. Earning above that before reaching FRA will reduce benefits by $1 for every $3 over.

The good news is that reduced benefits aren’t permanently lost. Once you reach your FRA, Social Security will recalculate your monthly benefit in a way that gradually adds the reduced amount back.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.